| 2019 | |

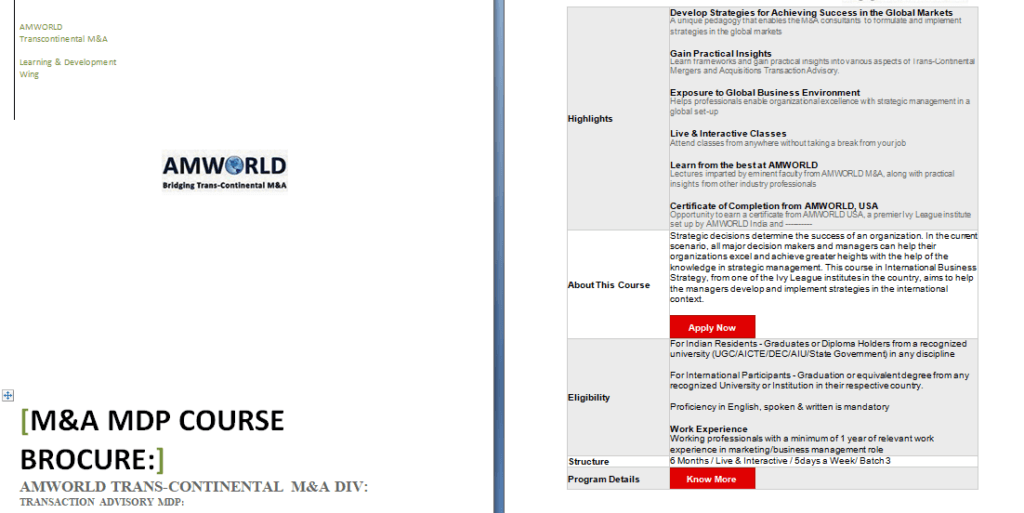

| AMWORLD Transcontinental M&A

Learning & Development Wing |

| [M&A MDP Course Brocure:] |

| AMWORLD Trans-Continental M&A Div:

Transaction Advisory MDP: |

| Highlights | Develop Strategies for Achieving Success in the Global Markets A unique pedagogy that enables the M&A consultants to formulate and implement strategies in the global markets Gain Practical Insights Exposure to Global Business Environment Live & Interactive Classes Learn from the best at AMWORLD Certificate of Completion from AMWORLD, USA |

|

| About This Course | Strategic decisions determine the success of an organization. In the current scenario, all major decision makers and managers can help their organizations excel and achieve greater heights with the help of the knowledge in strategic management. This course in International Business Strategy, from one of the Ivy League institutes in the country, aims to help the managers develop and implement strategies in the international context.

|

|

| Eligibility | For Indian Residents – Graduates or Diploma Holders from a recognized university (UGC/AICTE/DEC/AIU/State Government) in any discipline

For International Participants – Graduation or equivalent degree from any recognized University or Institution in their respective country. Proficiency in English, spoken & written is mandatory Work Experience |

|

| Structure | 6 Months / Live & Interactive / 5days a Week/ Batch 3 | |

| Program Details |

|

Table of contents

| 1.Mergers & Acquisitions- Strategic Perspectives | 2. Valuation and Pricing of a company |

| SWOT Analysis of the company | Modes of Valuation |

| Identification of the Target Company | Earnings basis |

| Due Diligence Inquiry | Asset basis |

| Selection of methods for merger or takeover | Discounted Cash Flows (DCF) |

| Financing the acquisition | Return on Investments (ROI) |

| 3. Procedures and Processes in an M&A | Return on Equity (ROE) |

| Step-by-step approach | 4. Analysis of M&A Transactions – Case Study |

| Negotiating the acquisition agreement | Experiences in an M&A deal |

| Finalizing the deal, etc. |

Course Outline

Introduction to M & A

- Explains the motivation behind mergers and acquisition

- Explains the cyclic nature of mergers and acquisitions

- Discusses the fundamentals of M&A deals in terms of volumes and value

- Explains the motivation behind M&A

- Briefly describe the stages involved in M&A deals

- Discusses the different categories of M&A deals such as horizontal, vertical and conglomerate mergers

- Explains the challenges faced in M&A deals

- Explains the rationale and objectives of M&A deal from the shareholder’s and managerial perspective

Seller’s perspective

- Explains the common reasons for selling a company

- Explains the process involved in selling and decision Path

- Illustrates the necessary steps involved in the sale such as selecting seller’s team, preparing the plan of action, understanding market dynamics and valuation, generating a target list, conducting legal audits, identifying marketing strategies to attract a prospective buyer and managing the process

- Illustrate common preparation mistakes

- Explains the importance of deal terms and terms that fits the sellers objective

- Explains plans and strategies post-closing

Buyer’s perspective

- Explains the steps in assembling the team such as lawyers, external auditors, valuation experts etc for external activities and finance, operations, sales and marketing team for internal activities

- Illustrates the process involved in designing the acquisition plan such as identifying the objective, outlining the plan etc

- Explains the process involved when approaching for sale

- Explains procedure to deal with the seller’s management team

Corporate Restructuring

- Illustrates the meaning and scope of restructuring

- Explains the modes of corporate restructuring

- Explains the steps involved in planning, formulation and execution of corporate restructuring strategies

Management Process

- Explains the types of risk, need of identifying risks, relative significance and process involved in mitigating risk

- Explains the process involved in risk management such as understanding the determinants of risk behavior

- Explains the purpose of assumption management and stage involved such as definition, verification and closure stage

- Explains the purpose of dependency management and stage involved such as definition, delivery, verification and closure stage

- Explains the quality management process such as conducting quality reviews and deliverables review

- Explains the process of cost management involving tracking and reviewing actual cost, cost variation, analyzing overall performance and reconciliation of the difference

- Describes the process involved in managing the resources taking into account required skills, supply, availability and cost

- Describes the steps involves in stakeholder management such as identifying all stakeholders, constraints imposed and understanding priorities of the stakeholder

- Explains the steps involved in communications management such as communication planning, information distribution and marinating performance reports

- Describes the issue management process and stages involved

Trans-Continental Mergers and acquisition

- Explains the key drivers for cross border merger and acquisitions

- Explains the trends and pattern of cross border merger and acquisition

- Illustrates the intensity of cross border deals

- Explains the value involvement and route of acquisition

- Explains inbound and outbound cross border M&A

Corporate demerger and reverse merger

- Explains the concept and modes of demerger

- Explains the reasons for Demerger and voluntary winding up

- Illustrates the procedural aspects of a reverse merger

- Explains tax aspects and relief’s policies

Due diligence

- Explains the key factor and process involved in conducting informative due diligence

- Explains different types of due diligence information such as internal and external information

- Explains the importance and process to conduct financial due diligence with a view to obtaining the previous profits of the company to canvas the financial futures

- Describes the process of legal due diligence which involves scrutinizing corporate, financial, management and employment matters

- Illustrates the use of business intelligence techniques in the process of commercial due diligence to obtain qualitative insight

- Explains the process of management due diligence involving the practice for acquirers to investigate to evaluate performances and to ensure the compatibility between the managements of the acquirer and target company

- Explains the need and requirement of ethical due diligence to determine the engagement of management in unethical professional acts

Valuation and Pricing

- Explains the key concepts and lessons of pricing

- Provides an overview of valuation

- Explains the basic methods of valuation such as comparable company and comparable transaction analysis, asset valuation, and discounted cash flow (DCF) valuation

- Illustrates the challenges in valuation such as evaluating small companies etc

Funding Mergers and Takeovers

- Illustrates different financial alternatives for debt-financing including asset-based lending, cash flow financing and equity financing

Negotiation and Bidding

- Describes the different takeover strategies such as toeholds, casual pass, bear hugs, tender offers, freeze out, fairness opinion

- Explains the process of negotiation involving identification of the starting point, resistance point, finding the agreement and determining the best solutions for both parties

- Explains the two styles of negotiation – Hard and Soft negotiation

- Illustrates the different strategies used for resisting hard-line attack

Post Merger Integration

- Explains the change management process for the acquirer

- Describes the process of integration planning to mitigate cost involving high-level merger planning, initial organization merger planning, post-deal integration and psychological integration

- Explains the key feature to integration success such as communication, leadership, client nurturing etc

Post-Acquisition Review

- Explains the importance of post-deal review and the process therein which involves reviewing strategies, analyzing the deal process and conducting post-deal audits

- Explains the role of advisors

Post Closing Issues

- Illustrates staffing level and human resources related issues

- Illustrates problems related to attitude and corporate culture

- Explains the issues related to corporate identity and legal issues

- Explains key lessons post-merger

Description

Why should I take a Merger & Acquisition certification?

This certification provides an overview of the techniques and practice involved in the process of merger and acquisitions & teaches you how mergers and acquisitions work. This course will impart students with invaluable foundation in strategies, regulations, closing a deal, pricing & valuation, and more. Students will learn exactly how M&A deals come together, and how to determine the ideal capital structure for a deal.

Learn & Study

- Fundamentals of M&A

- Understanding Seller’s & Buyer’s Viewpoint

- Corporate Restructuring Strategies

- Regulations concerning mergers & acquisitions

- Negotiation & Bidding

- Pricing & Valuation

- Post-Combination Entity

How will I benefit from Merger & Acquisition certification?

This certification asses the candidates on the basis of the rationale to select acquisition targets, valuation and capability to handle complex process such as identifying acquisition strategies, closing the deal, thinking through integration issues etc. Certified Merger and Acquisition Analyst can find employment in all kind of companies, big or small, playing important roles in providing strategic and operational guidance.

The certified candidates may get hired as consultants to companies or investment banks to acts as intermediary to broker a deal or serve as an advisor either to the acquirer or the target company, and may also help in financing a deal.

Companies that hire AMWORLD M&A Merger and Acquisition Analyst

AMWORLD M&A Certified Merger and Acquisition Analyst might find employment in various companies like Moody Brothers, Lehman Brothers, Verity(Credit Suisse), KPMG, E&Y, Tata Capital, Ikya Human Capital Solutions, PwC