1. Market Overview

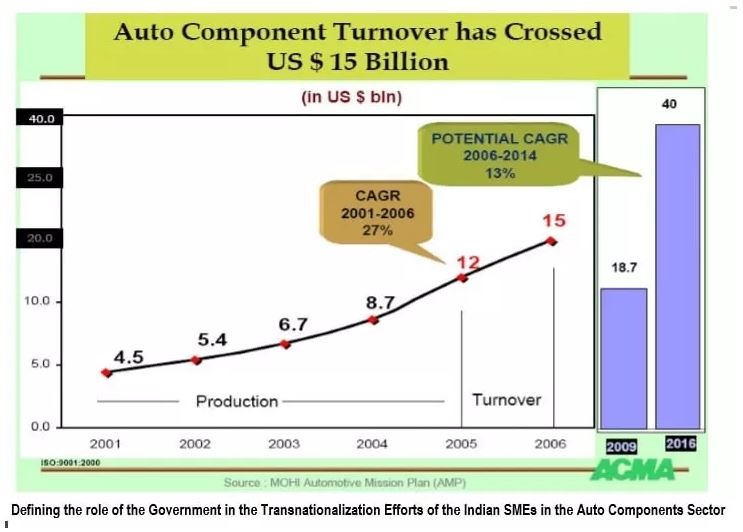

The Indian automotive component industry is small in size compared to the world market (112$ Bn). The industry has been experiencing a high growth rate of 27 percent over the period 2001-06 and is expected to grow at a rate of 13 percent over the period 2006-14. The quality of components made in India has improved significantly in the last decade and about 11 Indian auto component companies have won the Deming prize so far. India is estimated to have the potential to become one of the top five auto component economies by 2025.

2. Export Scenario

In 2006-07, automotive component exports from India were worth 1.7$ Bn and are expected to reach 12.8$ Bn in 2016. While growth rate of exports has been 38 percent during 2002-06, the export is expected to grow by 24.4 percent during 2006-15. India exports a vast range of automotive chassis and components. The major component categories that have shown a healthy growth in exports are vehicle components and accessories, transmission shaft and cranks, drive axles, starter motors, generators, and bumpers. The driving force behind India’s growing automotive components exports in the past has been higher exports by Indian subsidiaries of global OEMs and tier-I manufacturers.

3. Key Product Categories and Segments for Exports

The engine components segment is technology and capital intensive and is likely to be dominated by the existing major firms in the short to medium term. Engine technology is expected to move towards superior design (for optimal fuel consumption and lesser emission), thus access to such technologies will be limited to the existing major firms. Among drive transmission and steering components, the steering systems are among the critical components of a four-wheeler. The capital and technology intensive nature of the segment acts as an entry barrier for companies in the unorganized segment.